ELEVATE update on COVID-19 (Coronavirus)

12 November 2020

Indonesia’s Job Creation: ‘Omnibus Law’ impact on workers, the environment and what it means for companies sourcing there.

COVID-19’s impact on sourcing countries around the world has been devastating, leaving governments scrambling to keep businesses running and support the economy. Of particular interest for labor specialists and compliance practitioners all over the world has been the sweeping changes to the labor laws in Indonesia. On October 5th, 2020, the Indonesian House of Representatives passed an Omnibus Bill on Job Creation with the support of seven out of nine parties (source). The new law is expected to substantially change Indonesia’s labor system and natural resource management. The bill has amended 79 previous laws, inserting 174 new articles into them intending to attract more investment into the country in the wake of COVID-19 (source).

Fraught with international controversy, the Omnibus Bill has faced mounting opposition from labor unions, civil society, environmental NGOs, Human Rights organizations as well as religious groups, investment firms, and scientists. Workers, trade unions, and environmental activists are forming unlikely alliances over Joko Widodo’s controversial economic stimulus plan and newly passed Job Creation law. Many say the bill will do more harm than good to workers, their rights, indigenous communities, and the environment.

What does the law do? Impact on workers:

- Sectorial minimum wages have been replaced by minimums set by regional governors.

- Severance pay has been reduced from 32 months’ pay to only 19 months.

- Overtime has been increased to allow a maximum of 4 hours a day and 18 hours a week.

- Businesses will only be required to give workers one day off a week instead of the previous two.

- No longer maximum periods of fixed-term employment agreements (Article 59)

- The right to request dismissal has been removed (Article 169)

- New Social Security program to provide benefits for terminated employees

Impact on the environment:

- Relaxes environmental standards

- Only requires businesses to file an environmental impact analysis if projects are considered ‘high risk’

- The local population are no longer required to be involved in assessing the environmental impact of business activities

- Local government authority is now under the central government.

Demonstration against the Omnibus Law in Yogyakarta, back in August this year. Photo: Zakki Photo Creative

How are these changes impacting sourcing and assessment practices in Indonesia?

Currently, there are no significant changes as we wait for the government’s and ministry’s regulation on the Omnibus Law and further updates to it.

Recommendations from ELEVATE:

The trading environment continues to surprise us in 2020. In Indonesia, when a new law is passed, it is enacted when the president signs it within 30 days of passage. But even without the president’s signature, a law automatically takes effect after 30 days (source). ELEVATE will continue to monitor the situation, as the changes will likely alter the risk exposed to companies sourcing there (and thus, our EiQ index may change for Indonesia in 2021).

ELEVATE has not done an in-depth analysis of what gaps, if any, might exist between typical standards regarding social responsibility and sustainability. We recommend that corporate responsibility and sustainability professionals profile suppliers for risks – ELEVATE can conduct research or provide a risk assessment of supplier profiles. In addition, sourcing and compliance practitioners should recognize there may be larger gaps between any areas of a supplier code of conduct that exceed local legal requirements. Understanding where those gaps are and communicating to suppliers any above-and-beyond expectations is important to the assurance process and will minimize any potential challenges to supplier audits conducted in the short-term.

15 October 2020

COVID-19 Preparedness, Health and Safety Trends from ELEVATE’s EiQ Data

In the manufacturing sector, the aftermath from the first wave of COVID-19 resulted in factory closures, major fluctuations in business orders, and depending on the supply chain, temporary pauses to production due to government lockdowns. Factories had to quickly learn to adapt to unpredictable demand, manage and workforce capacity while responding to a public health crisis with little to no experience in responding to such a crisis.

As specialists in social and environmental compliance we have been tracking factory pandemic preparedness and vulnerability. ELEVATE’s Supplemental Data Sheet (SDS) is a unique data capture tool that is included in all ELEVATE audit reports. The SDS includes over 70 different quantitative data points on key social, environment and business metrics which are collected and verified by ELEVATE auditors onsite. At the onset of COVID-19, ELEVATE added COVID-19 related questions to the SDS checklist. Data collected during the audit is segmented by country and the data is analyzed in three buckets:

- COVID Preparedness– This section includes questions covering awareness and prevention measures taken by factories during the pandemic. This could potentially indicate the vulnerability of factories during pandemic related risks.

- Social Distancing– This section addresses existing social distancing protocols in factories.

- COVID Respondence– This section measures factories’ “capacity” (or) “approach” to deal with COVID related risks

Below is a summary of our global findings from remote and onsite audits between May – August 2020.

How well are factories prepared to address COVID related risks?

- Factory preparedness is measured based on whether factories have appropriate sign postings, instructions on-site, availability of temperature checks, handwashing / sanitizing, provision of masks, gloves, etc.

- In countries where ELEVATE has been able to conduct audits on average 11% of factories do not have basic temperature and symptom checks. This risk is heightened in countries such as Turkey, United States, and Vietnam where over 15% of the factories don’t have temperature checks.

- Only 67% of Burmese factories go through regular cleaning of the premises leaving 33% of Burmese factories in vulnerable state.

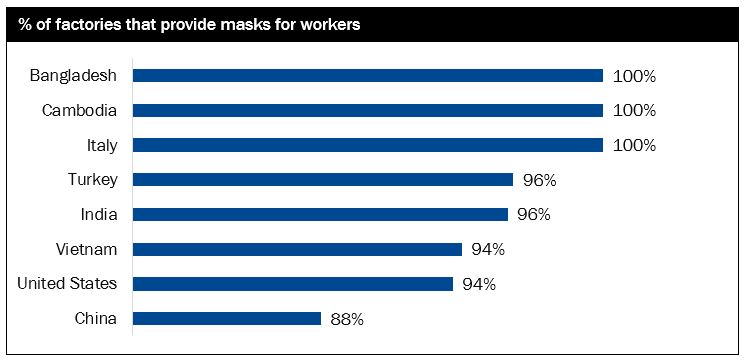

- 12% of factories in China do not provide masks or gloves to their workers during the pandemic.

EiQ SDS Data

EiQ SDS Data

What are the social distancing measures in facilities?

- The global average for social distancing at sites and facilities stands at 81%, but at small facilities implementing and maintaining these distancing measures can be difficult.

- Among key sourcing countries, Bangladesh and Vietnam see the lowest social distancing protocols.

- Only half the factories globally have staggered shifts. The majority of the factories in Vietnam, China and Turkey do not practice staggered shifts.

How well do factories respond to COVID related risks?

- Factory response to COVID is measured based on how factories react and approach when encountered with a COVID case.

- 24% of factories in Turkey do not follow up or take appropriate measures when a worker shows symptoms.

- 43% of the factories have poor disinfection measures inside the facility to control spread of the virus in case a worker is infected.

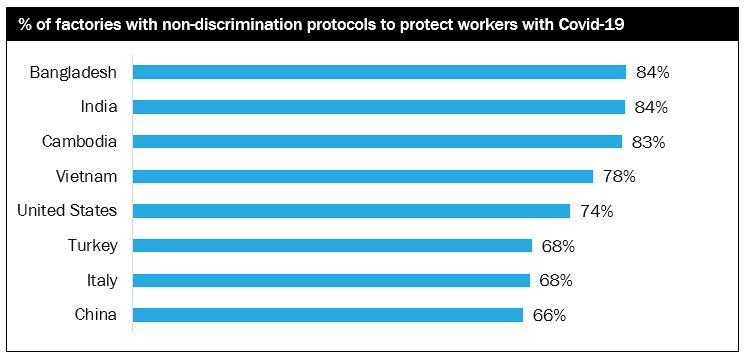

- China, Italy, Myanmar, Turkey, United States and Vietnam have discrimination and retaliation issues against workers with COVID.

EiQ SDS Data

EiQ SDS Data

The data suggests factories had health and safety protocols in place pre-pandemic, such as safety instructions on-site, availability of temperature checks, and handwashing / sanitizing stations. However, there is room for improvement, especially to support workers who become infected. Key health and safety points and takeaways for areas of focus include:

- Implement basic infection prevention measures, frequent handwashing, access to hand sanitation regular housekeeping and cleaning of sites

- Providing and ensuring utilization of personal protective equipment for all workers

- Providing factory workers with continued trainings on how to best protect themselves at the worksite

- Ensuring safe working conditions through increased communication with workers on the importance of social distancing measures and limit group work

14 September 2020

The early read: what COVID-19 has revealed about vulnerabilities in select US industries

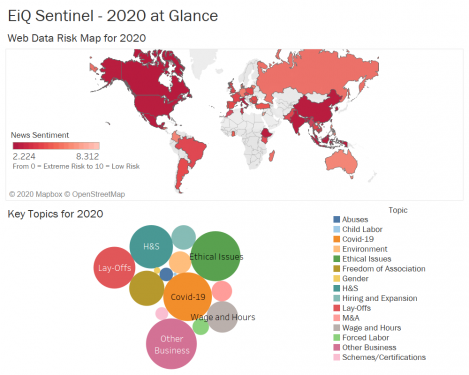

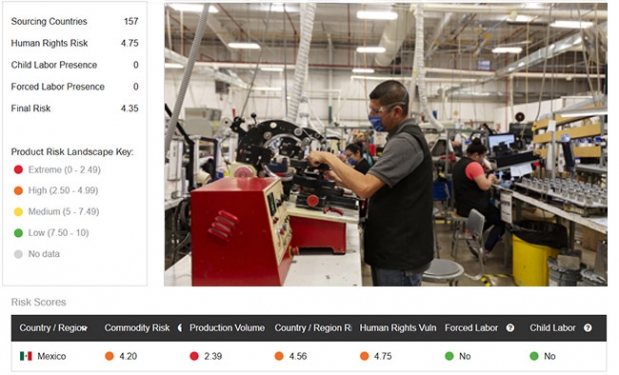

The U.S. currently stands at 6.03 million confirmed cases of COVID-19, with outbreaks in supply chains across multiple essential businesses. With the pandemic still raging, economic recovery is threatened by resurgences in coronavirus cases, especially in factories that are prone to cluster outbreaks (source). In the past month ELEVATE webcrawler technology has detected numerous media stories in the USA and on the topics of health and safety risks in the workplace, lay-offs and compliance violations related to compensation. EiQ Sentinel risk data suggests that North America, including the U.S. is reporting extreme risk. The map below shows countries color-coded by the level or risk as reported in ELEVATE’s analysis of publicly available news outlets and data. The bubble graph reports what types of risk have been mentioned in 2020.

EiQ Sentinel Data

Prior to the pandemic ELEVATE raised the risk rate of the USA. The 2020 risk scores show the United States declining a significant 12% over the last 5 years from a score of 5.63 (medium risk) to 4.96 (high risk), due to the increased risks associated with migrant workers, forced labor, workplace injuries and environmental permits.

COVID-19 has caused the deepest recession of the US economy since the Great Depression (source). Recently, the US Commerce Department reported an uptick in in manufacturing as businesses reopened and demand increased. The pandemic has impacted nearly all industries.

This week we explore what the pandemic has revealed about the manufacturing sector in the US.

Poultry:

Poultry processing plants have struggled to keep workers safe while continuing to provide a steady supply of product since the outbreak. Reports suggest that prior to COVID workers had limited access to paid sick leave, limited safety information in appropriate languages and little or no communication regarding incident of illness and fatality, and now a lack of social distancing measures on processing lines (source). Early in March and April the virus rapidly spread among meat workers forcing major facilities to shut down before direct orders from the President to reopen. As a result, the number of current COVID-19 infections deriving from poultry plants is unknown as many companies are keeping this information private (source).

Warehouse Workers:

Warehouse and fulfillment center workers are essential workers, working around the clock to ensure customers have items delivered to their doorstep on-time. Accounts of warehouses staying open despite cases of COVID-19, in one warehouse 30 employees tested positive, are worrying. Warehouses can potentially become super-spreaders of the virus. Workers have been petitioning for funds for child care, subsidies, 1.5x hazard pay to compensate for the “added health and financial risk” and an end to rate-based write ups (source).

Apparel:

Though small, the U.S apparel industry first made headlines for its swift respond to change production lines to PPE. Los Angeles is the hub of the US garment industry and is a hotbed for the virus. After the outbreak of the pandemic in the US, the Los Angeles Retaliation Complain Investigation Unit received hundreds of reports and formal complaints relating to the pandemic and health and safety concerns. The County Department of Public Health ordered one manufacturer to close amid ‘flagrant violations’ (source). Another garment factory was noted to have 300 hundred people test positive for the novel coronavirus, and four of those have died (source).

The majority of garment workers are low-wage workers and many of whom are undocumented – they do not qualify for unemployment benefits (source). Prior to the pandemic workers lacked basic protections and now, social distancing measures are nearly impossible to maintain in cramped and poorly ventilated spaces (source). Most are too afraid to report unsafe working conditions for fear of losing their jobs. This is compounded by the fear of the financial repercussions that would follow from unemployment and the fear of securing another job in this economy (source).

A new bill in the U.S., Senate Bill 1399 the Garment Worker Protection Act, is under review to reform safety measures and practices of garment manufacturing facilities. The bill has been approved on the Senate floor in the state of California, and passed the California House Credit Committee making its way into the office of California Governor Gavin Newsom (source). This is a turning point for sustainable and ethical apparel manufacturing in the U.S., the bill pushes for minimum wages for garment workers and no piece rate pay. This bill holds brands and retailers responsible for their contractors, make piece rate pay illegal in California and provide protection and safety to garment workers (source).

Providing safe working environments is key to building back and sustaining business after COVID-19 while keeping workers safe and healthy.

19 August 2020

Business’ reactions to the COVID-19 pandemic highlights the precarious situation of workers – apparel industry manufacturing insights

The global pandemic continues to have an economic impact across the apparel and textile sector. Lockdowns and store closures around the world have dramatically impacted the manufacturing industry causing millions of factory workers to lose their jobs (source). As of August, the financial impact is estimated at $3.7 billion in canceled orders (source). Seven months on from the initial COVID-19 outbreak, ELEVATE is taking a deeper dive into the business impact on the apparel industry in Bangladesh and China.

Bangladesh:

The apparel industry makes up nearly 85% of Bangladesh’s export earnings and is a key economic engine for the country (source). At the onset of the pandemic brands and retailers rushed to cancel orders as demand drastically fell. This decrease in orders caused factories to temporarily close. Previously a $33 billion industry, the pandemic crippled the apparel industry in Bangladesh to the lowest it had been in two decades. Rubana Huq, current president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), an association of garment industry owners, describes the impact of COVID-19 on Bangladesh as “disastrous, with a complete disruption to the supply chain, stemming from the demand side.” She explains that for the first time the BGMEA has realized how vulnerable the garment supply chain is (source).

The World Trade Organization reports that orders received by Bangladesh’s garment factories declined by over 45% over the first quarter of 2020, representing $316 million in order cancellations and suspensions, with an 81% contraction in April alone. However, the apparel industry is slowly turning around. In April Bangladesh exported $370 million worth of clothing, in May $1.23 billion was exported, and in June it rose again to $2.25 billion. Rubana Huq explains that she does not see a significant recovery happening until spring 2021, but that things are slowly heading in the right direction (source).

Workers protest in Dhaka, Bangladesh, in May 2020 to demand payment of their due wages Photo credit: SK Hassan Ali

Selected brands have agreed to buy suspended and canceled orders after social media campaigns pressured them to do so. Uncertainty lingers for small and medium-size factories. Abdus Salam Murshedy, the former president of the BGMEA said, “even though big factories are receiving orders, small and medium factories are not seeing the same influx of orders and it is causing great stress on factory owners to pay their workers through to September.” The Asian Development Bank is reporting that around 1.4 million Bangladeshis have lost their job (source). Support has come mostly in the form of aid a grant of €113 million from the EU to pay three months’ salary for 1 million workers in Bangladesh (source), and stimulus packages from the Bangladeshi government for Tk1.03 trillion for different sectors, including apparel (source). However, this is only a short-term solution.

Current Situation for factories and workers:

- Garment factories are at 55% capacity for August/September

- Spinning and weaving mills are running at 75% capacity

- Buyers are placing orders, but between 5-15% lower than prices offered normally (source)

- Firms are reporting low ‘business confidence’ for the period of July-September (source)

- Wide-spread flooding has made economic hardships worse

China:

Covid-19’s impact on China’s apparel industry has also been significant. In February factory doors were shuttered amidst lockdowns and travel restrictions, impacting thousands of factories and millions of jobs. Today, many factories are back in business. While factories are back up and running, an estimated 50,000 factories have gone out of business due to the pandemic and more many are struggling. Overall, China’s average loss of orders was around 30%, with 22.8% down on exports of apparel between January and May (source). Factories have been negatively impacted by delayed payments from customers, canceled orders, and delayed shipments.

Thousands of companies across China pivoted in the face of the pandemic and switched their production to mask-making. They are now struggling to continue in the face of more strict quality control measures (source). While the demand for face masks and PPE has skyrocketed leading to many lucrative contracts for large-scale Chinese manufacturers as is often the case with rapid and large scale transitions, workers are paying the price. Workers lack proper training and are forced to work in intense working environments resulting in exhaustion, 12-hour shifts, a spate of accidents, and conflict between workers and guards (source).

Photo credit: China Daily

Coupled with the China-US trade war China’s 290 million migrant workers have been hardest hit by the pandemic. China’s export manufacturing industry is seeing factory closures and extensive job losses from the pressure of the trade war, which is having a domino effect on local communities, restaurants, hotels, and shops that rely on those workers for their income (source). In July the U.S. government issued a joint advisory urging U.S. companies to monitor their activities in China. Both the trade war and advisories are adding to the complexity of sourcing from China.

While China is not back to where it was pre-COVID, there are signs of apparel sector recovery. Recruitment is active and people are hiring with job interviews happening daily. Chen Dapeng, president of the China National Garment Association and president of the Fashion Fair Chic, maintains a confident outlook for the Chinese apparel industry amidst sharp declines in demand, store closures, logistic challenges, and tremendous pressure for factories to survive (source).

Current Situation for factories and workers:

- Average factory capacity is around 50-60%

- Some factories are reporting 25% of last year’s earnings

- Estimated 50,000 factories have gone out of business

- Demand on China for raw materials, 70% of woven fabrics come from China (source)

- 15.6% reduction in current year apparel manufacturing revenue (source )

- The jobless rate was down to 5.7% in June from 5.9% in May (data does not include migrant workers) (source)

Food for thought:

As brands and retailers work to overcome the massive reduction in consumer demand and the resulting significant financial impact of the pandemic (leading to many bankruptcies), the upstream impact on the supply chain has been no less devastating. There will be new risks arising from tightening liquidity in factories, labor shortages, managing COVID in the workplace to name a few. On the one hand, retailers and brands will want to drive down the costs of responsible sourcing. On the other, they will need to balance this with the need to remain vigilant to emerging issues in the supply chain.

30 July 2020

COVID-19 and India: balancing order cancellation, economic recovery and worker unrest dated 30 July 2020

The impact of COVID-19 on business and supply chains continues to be devastating, resulting in an unprecedented humanitarian and economic crisis. India is currently one of the countries with the highest number of COVID-19 cases, over 1.5 million. On March 24, 2020, the Prime Minister of India ordered a nationwide lockdown for 21 days, limiting movement of the country’s 1.3 billion population, and ordering people to stay home. With factory closures and most of the economy shut down the announcement effectively left 400 million workers stranded (source). The strictly imposed lockdown resulted in a 13% drop in employment (114 million workers out of work) (source). Lockdowns were subsequently extended with travel restriction varying from state to state. Some states relaxed their restrictions, basing their guidance on the number of infections and allowed businesses/factories to return to work whereas others introduced stringent rules and enforced mandatory quarantines. The response of some state governments was to amend labor laws. The proposed changes and suspensions to India’s labor laws are a COVID-19 economic mitigation strategy. For brands and retailers sourcing from India it is important to understand the implications for social compliance standards.

While India has welfare measures in place for those that fall below the poverty line, often migrant workers and informal workers (those with no written contract, paid leave, health benefits or social security) fall between the cracks (source). Migrant workers in cities like Delhi, Mumbai, Bangalore, Chennai and Kolkata, had to return to their villages: initially on foot (with reports of some facing starvation) until some state governments provided buses, ran Shramik Special trains to ferry workers back home and sought the voluntary help from soup kitchens and shelters (source).

From a sourcing perspective, India presents significant risks for the presence of child labor and forced labor, incorrect wage payment, illegal termination, forced lay-offs and non-compliance to working hours standards (ELEVATE EiQ). Data suggests that only 10% of workers are formally employed, protected by labor laws and work in safe working conditions with social security (source). Migrant laborers are among the most vulnerable making up the majority of India’s workforce. With the mass movement of workers returning home the result was a shortage of labor. As the virus continues to spread more vulnerable workers will be pushed into more precarious situations, choosing between the fear of zero income and catching the virus. To attract workers the finance minister Nirmala Sitharaman in March announced free food, fuel and cash transfers to workers and farmers for three months, the free food program has since been extended until November (source).

Labor Law Changes:

In India, labor issues are part of the concurrent list, so states can frame their own laws, however they require the president’s approval to amend the central law of India (source). As of July 30, 2020 the president has not passed any laws.

There have been proposed law amendments by several Indian states. In May 2020, Indian state governments including those of Gujarat, Punjab, Rajasthan, Himachal Pradesh, Assam, Haryana, Madhya Pradesh, Uttar Pradesh, Odisha, Goa and Maharashtra proposed changes to labor laws and social welfare. Uttar Pradesh, Gujarat and Madhya Pradesh had brought proposals in the form of ordinance to suspend majority of labor laws in their states for up to three years (source).

One implication of the proposed amendments is an increase in working hours. The labor ministry has finalized two labor codes that give flexibility to state governments related to hiring, retrenchment and fixing work hours in factories and establishments while imposing restraints on workers forming unions (source). Some states have given exemptions on working hour limits for the next three months to compensate factory closures due to COVID-19, increasing working hours from 8 to 12 hours a day. However, while the Labor Ministry has deemed the increase in working hours “illegal” requiring employers to pay workers overtime past 8 hours (source), there is fear that the shortage of labor and desperation of workers will lead to exploitation.

Photo credit: AFP

Order Cancellations:

Exacerbating the situation is the cancellation of orders that have already been fulfilled. Throughout India order cancellations, deferred payment terms and reduced order volumes have been rampant, with major brands and retailers delaying and cancelling orders in response to the pandemic forcing store closures across the world (source). On May 18th The Times of India reported, “80% cancellation of export orders for ready-made garments and fabrics while yarn shipments have seen as much as 50% cancellation (source).” This impacts neighboring Bangladesh that receives large amounts of woven and knitting fabrics from India where workers are also feeling the effects of order cancellations. Exporters and manufacturing associations have appealed to the government for a relief package, it is the second largest employer in India after agriculture (source). NGOs have joined suppliers and associations asking buyers to fulfill existing contractual obligations. In June, workers joined in the calls by protesting after a factory closures left 1,000 jobless (source). By late July, the #PayUp campaign unlocked $15 billion of lost wages due to cancelled orders from major brands (source).

To support the safety, security and well-being of workers in India and uphold international labor guidelines industry groups and NGOs have been pressuring Prime Minister Modi to not pass proposed ordinances into law. Industry associations are among such groups sending letters to the Indian Prime Minister Modi urging him to reject proposals to weaken and suspend labor laws in response to COVID-19. They argue that these changes would seriously jeopardize the well-being and safety of workers and harm India’s commitment to worker rights and fair labor and violate the ILO Convention.

24 June 2020

How COVID-19 is impacting social responsibility dated 24 June 2020

The global pandemic has revealed the complexity of supply chains, exposed inequities in the global workforce and altered consumer spending patterns in ways unforeseen. To ensure the future of the business, leaders are being forced to make difficult decisions on what is essential and what is not. For many, the value of sustainability efforts is being called into question. As risks are accelerating and priorities are shifting, there is an unspoken question emerging about the relevance and value of social responsibility.

Before the pandemic the retail industry, particularly in the US, faced financial challenges as consumers shifted spending habits online and the industry became overextended in real estate. At the onset of the stay-at-home orders, publicly listed apparel and fashion companies in North America were at risk of deep financial stress (source). Department stores, clothing brands, restaurant chains, and the entertainment industry have all been impacted by the devastation of the U.S. economy. Several established businesses have filed for bankruptcy (source). Even though bankruptcy doesn’t necessarily mean a company will go out of business, the financial restructuring is a sign of changes to come.

Sustainability teams are starting to feel the impacts of the financial uncertainty. The COVID-19 health pandemic, followed by the economic devastation, prompted business to decrease sustainability staff from full to part-time or in some cases, place staff on furlough. In a best-case scenario sustainability is playing a role in the company’s response to COVID-19. According to a recent survey released by GlobeScan and BSR, “the focus of responses to the crisis has most commonly been around protecting the workforce.” However, “over four-in-ten report a significant impact on their day to day work” (source). The survey also found that there is a belief sustainable supply chains will be the sustainability element most likely to be impacted by the crisis (source).

This uncertainty is prompting our partners to ask ELEVATE if they should approach their programs as they did pre-pandemic, or if retailers and brands should rethink the approach to supply chain due diligence? With constant change, new priorities and limited resources, how should time be allocated? As factories reopen, ELEVATE is scheduling and conducting audits on behalf of our clients. Recently, audits had to be canceled due to cases of COVID among factory workers. This begs another question – just because we can go back to “normal” ways of operating, should we?

Unfortunately, it appears that we may be closer to the beginning of this crisis than the end. It would serve us well to remember that the origin of Corporate Social Responsibility (CSR) is to help identify, manage and avoid the negative impact normal business operations can have on reputation, and to seek opportunities for better business performance, whether it be employees, the community as a whole or the environment. . It often takes a crisis to drive real change – in response to this crisis, what should our focus be? The devastating loss of life at Rana Plaza moved business to make significant commitments to improvement building electrical and fire safety in the RMG sector. Will this pandemic be an impetus to create positive change?

From our perspective, an effective program balances business and social risks and impacts, which is more important now than ever. When thinking about (or rethinking) program approach and effectiveness, we challenge brands and retailers to consider the following:

- How does your program contribute to business performance for your company and your suppliers?

- What are your biggest supply chain risks?

- Does your program have the information necessary to protect and enhance brand reputation?

- How can responsible sourcing be integrated throughout the business?

- What are your company’s top priorities and where does CSR fit?

- How can you create the same impact, or more, with less resources?

- What internal practices does your program need to review that may inadvertently be creating negative impacts to workers?

- Where in the value chain can your company have the most positive impact on worker lives?

ELEVATE is supporting its customers to help answer these questions and adjust program strategy and priorities for the upcoming budget cycle. Be part of the solution and help proactively define the path forward or you may have it defined for you.

17 June 2020

How COVID-19 is exposing the vulnerability of the global food supply chain dated 17 June 2020

At the onset of the pandemic the public was assured the food supply chain was stable and stocking up on foodstuffs was not necessary (source). In our April 21st webinar, ELEVATE and Equitable Food Initiative (“EFI”), warned of the challenge to maintain both the continuity of the food supply chain while protecting workers’ health. By late April, the meat industry warned of shortages as COVID-19 quickly spread to workers at poultry plants (source). Most recently, there are reported cases of the spread of COVID across the entire workforce at farms in the US (source). As with many other supply chains, COVID-19 has shed light on the vulnerability of the global food system and its workforce.

Farms across the world depend on skilled, temporary laborers – many of which are foreign migrants on visa programs. In the United States, 73% of the agriculture labor force is made up of immigrants (source), 10% is dependent on H-2A seasonal workers (source) with estimates of 50-75% of all crop hands are estimated to be undocumented (source). In the US field workers were told to keep working under an executive order deeming agriculture workers, “essential” (source). These workers have particular risks including a lack of sick pay, lack of health insurance and lack of understanding the risk of COVID-19 given language barriers. Workers crowd onto buses to work at farms across the country and often live in cramped housing. The nature of the work in the field makes it difficult to social distance. Testing of workers at one farm in Tennessee in the US, revealed that every single worker (200) had been infected (source).

Globally, many food and agricultural workers live and work in precarious conditions, often without access to adequate hygiene, sanitation and protective equipment. The UN’s Food and Agricultural Organization (FAO) is pushing for response measures to focus on protecting workers at work, through supporting employment, incomes for the most vulnerable and arguing for access to response measures, including health and social protection for all migrants regardless of their migratory or working status (source).

Photo credit: Joe Klamar

With many boarders closed, the delayed arrival of foreign workers could lead to lower production and higher food prices. Measures affecting the movement of people will have an impact supply chain continuity. Industry experts have been warning of the consequences of a lack of workers during harvest season. In the Andalusian province of Huelva in Spain only about 7,000 of the 19,000 Moroccan seasonal migrants arrived before Morocco closed its border. Some 90% of Italy’s agricultural workers are seasonal, with many coming from Romania. France reported a shortage of some 200,000 agricultural workers (source).

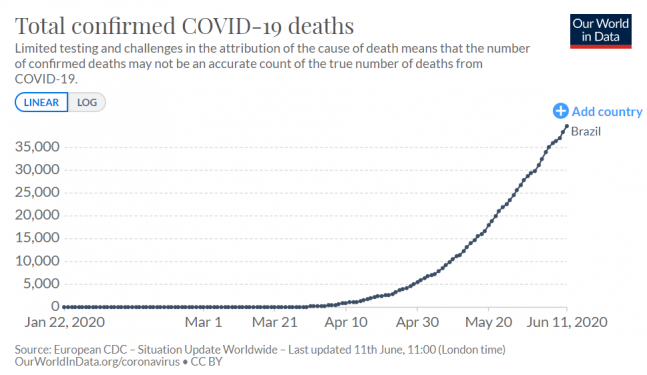

Risk to workers and to the supply chain are also present at the manufacturing level. The meatpacking industry in the top two meat producing countries, the US and Brazil, has been struggling to contain cluster outbreaks. In some food facilities in the US, up to 44% of workers have tested positive (source). According to data from FERN nearly 25,000 meatpacking workers have contracted COVID-19, resulting in 92 deaths. Brazil’s meat industry is under similar stress as states hardest hit by the virus are seeing cluster outbreaks amongst slaughterhouses. Rio Grande do Sul, Santa Catarina and Parana, account for 70% of poultry production and 65% of pork production in the country (source).

Pandemic related restrictions are causing disruption on supply chain logistics. Strict quarantine measures around the world have had an effect on the amount of storage containers that are able to be loaded and unloaded (source), leaving stock piles of produce to rot or go stale (source). For sectors with a significant percentage of smallholder farmers, the restriction of movements and road closures curb farmers’ access to markets both to buy inputs and sell products. The result is that product can accumulate without being sold, leading to food losses, while those who grow it lose income (source).

The crisis is exposing the vulnerability of the food supply chain and its workers, including in what have been historically lower-risk countries. ELEVATE is taking a closer look at the impact COVID-19 is having on the food and agriculture industry and the people that grow our food. Please contact Meghan Quinlan if you would like to further explore these issues.

11 June 2020

Insights from Latin America dated 11 June 2020

This week our Regional Manager, based in ELEVATE’s Mexico office, provided us with insights on supply chains and assessments in Latin America. The region has become the new epicenter for COVID-19. Brazil now stands at over 770,000 confirmed cases, Mexico is reporting over 120,000 cases, Peru over 200,000 and Chile nearing 150,000 (source) and in Guatemala apparel factories are facing cluster outbreaks of COVID-19. Supply chain disruption is occurring across Latin America, but the greatest impact is to the large manufacturing countries. Extensive spread of the virus throughout Latin American has resulted in an economic slowdown, health and safety concerns and supply chain disruptions.

Brazil

- Eight of the 26 Brazilian states are reopening commerce.

- Factories have been provided health and safety measures to implement in their workplaces.

- COVID-19 cases have increased among poultry processing plant workers, with cluster outbreaks in 18 slaughterhouses. The Brazilian states hardest hit by the virus, Rio Grande do Sul, Santa Catarina and Parana, account for 70% of poultry production and 65% of pork production in the country (source).

- Automotive manufacturing plunged by 99%, as demand for cars has drastically reduced due to the pandemic. In April 2020 Brazilian manufactures produced 1,800 cars compared to 200,000-250,000 pre-COVID-19 (source).

- Brazil is considered high risk for deforestation (source: EiQ Risk Analytics, 2020). The Brazil government has used the distraction of COVID to rollback legislation protecting the environment, leading to a severe increase in deforestation (source).

Colombia

- In April, production of coffee fell 28% and exports fell 32% (source). Similarly, coffee supply chains are being hit on all fronts. The closure of commercialized coffee businesses is decreasing roasters’ demand for green coffee lowering their purchase commitments. Exporters are keeping excess coffee in warehouses, leaving coffee to go stale, and difficult to sell later. Similarly, producers with product detained in ports, must cover penalties, or seek other options to move the coffee (source).

- The National Federation of Colombian Coffee Growers met in a virtual conference to discuss and implement safety measures for coffee workers, including spaced out dormitories, scheduled lunch hours, and isolating any suspected cases of COVID-19. Overall, however, they are confident that coffee farms are relatively safe given their rural locations.

- It is suspected that, by the middle of the year, labor will be scarce for the harvest season of coffee beans as farm workers who are overwhelmingly foreign migrants are unable or unwilling to cross borders to work (source).

Photography courtesy of Devoción

Guatemala

- Guatemala is deemed a ‘high-risk’ sourcing country. A commodity risk score is a weighted average score of production volume, country/region risk and human right vulnerability risk (Source: EiQ Product Risk Landscape 2020).

- Factories throughout Guatemala have been producing PPE for export to the US, focusing on the manufacturing of face masks and protective gowns and suits (source).

- Compliance checks are carried out by Baja California government labor inspectors on maquiladoras – largely foreign-owned factories that manufacture products for export – that have reopened. Failure to comply with the necessary measures in place by the government, can lead to suspension.

- Textile plants are facing cluster outbreaks of COVID-19, due to lack of social distancing and proper PPE. A state of emergency was declared in San Miguel Petapa, after a single textile factory had over 200 cases (source).

- Other maquiladora factories have been shut down, due to flaws in health protocols such as workers gathering outside the factories waiting for their shifts, and gathering in small areas during lunch and break times (source).

- Transit between cities is prohibited, only cargo transportation can move around.

Photo credit: Just Style

Mexico

- In anonymous surveys deployed prior to the pandemic 63.2% of male workers and 64.7% of female workers said they are willing to speak up if they had a suggestion or a complaint (Source: ELEVATE’s Worker Sentiment Scorecard, Jan 2019 – Jan 2020). Numerous strikes have taken place as workers are fearful for their health. In some cases, workers who chose to strike have been fired (source).

- Along the border of Mexico and the US numerous maquiladoras have been the focus of cluster COVID-19 outbreaks (source). Official efforts to keep the factories shut and contain the spread of Covid-19 have come under intense pressure from companies – and US government officials – who have urged the Mexican government to keep maquiladoras open. Baja California, the Mexican state with the largest number of maquiladoras, is the now the state with the second-greatest number of Covid-19 deaths.

- In Ciudad Juárez, 18 workers at a textile factory reportedly died of coronavirus. The company has said that it stopped production there on 27 March and that it moved affected employees to a private health care center for treatment at the company’s expense (source).

- The Baja California government has insisted that reopened maquiladoras need to observe strict hygiene standards. But the state employs only 15 labor inspectors across all sectors, so paroling and implementing these standards is proving difficult (source).

- U.S. and Mexican industry groups say they believe most production can continue safely with more shifts and fewer workers per shift along with additional health measures (source).

A note on auditing in Latin America during COVID-19:

ELEVATE is ensuring the safety of assessors across Latin America, implementing health and safety measures recommended by local governments and complying to all travel restrictions. ELEVATE is currently conducting both virtual and onsite assessments throughout Brazil, Guatemala and Peru. ELEVATE plans to resume onsite auditing in Mexico by mid-June 2020.

5 June 2020

Standing with vulnerable workers dated 5 June 2020

For the past week the United States and other countries have seen widespread protests against injustice, in many cases evoking Martin Luther King’s quote, “Injustice anywhere is a threat to justice everywhere.” Read the full text here

27 May 2020

The Emerging Risk Landscape During COVID-19 Recovery Dated 27 May 2020

The impact of COVID-19 is unprecedented. News outlets around the world have reported the consequences of production shutdowns, order cancellations, and overall disruption to global supply chains on suppliers’ operations and financial stability. These effects have trickled down to the factory floor, putting working conditions and workers’ livelihoods at significant risk.

Early analytics from our EiQ supply chain intelligence platform. suggest there are emerging insights that should continue to be closely monitored as countries, factories and brands work through the recovery.

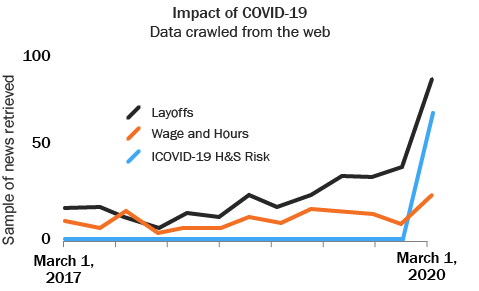

Insight 1: News trends have focused on lay-offs, wage payments and excessive overtime.

The ELEVATE Analytics team systematically evaluated online news articles on over 30,000 factories using its EiQ Sentinel product. An analysis of a sample of these suppliers suggests that the sudden surge of the H&S risk related to COVID-19 in Q1 2020 correlated with:

- An increase of lay-off related news by 112% compared to Q4-2019

- An increase in wage and working hour violations news by 189% compared to Q4-2019

EiQ Data – May 2020

EiQ Data – May 2020

These issues continue to be material and relevant in all on-the-ground audits as well as remote assessments. Leaders in the industry are evaluating risks relating to unfair dismals, severance payments, correct wage payments alongside a more in-depth focus on health, hygiene and COVID-19 readiness / return to work metrics.

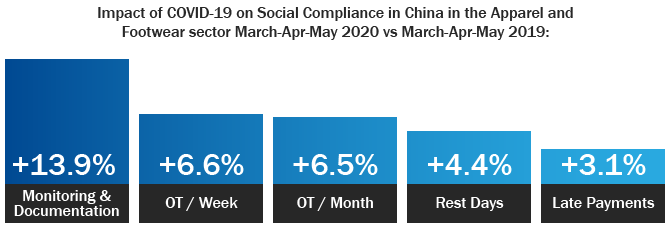

Insight 2: Early data from China audits (post COVID-19) suggests challenges on overtime payments and documentation.

If China is any indication for the future, ELEVATE’s audit data shows a statistically significant increase several issues across the apparel and footwear industry including overtime wage related violations, rest days, late payments and documentation issues. The data chart below compares Spring 2019 vs Spring 2020. We have highlighted the estimated increases in violation.

EiQ Data – May 2020

EiQ Data – May 2020

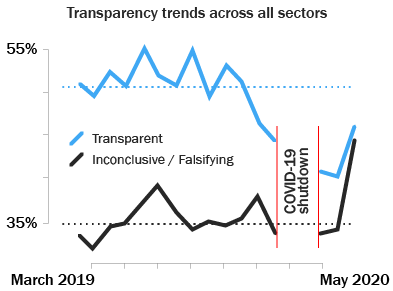

Insight 3: Transparency is declining

The impact documented above is only partially representing the ongoing deterioration of working conditions in the supply chain. COVID-19 has significantly affected transparency as measured by factory managers providing clear and unadulterated documentation during the audit process.

With lower transparency, brands are no longer able to assess supply chain risk among their business partners. Lack of transparency also prevents brands from ensuring that their investments in improving or maintaining working conditions (e.g. all workers being paid their salary during the shut-down) are reflected at the factory level.

As per May 2020, the percentage of inconclusive or falsifying factories is higher than transparent factories. This is quite a regression. Since January 2017 transparency rates have always been greater than inconclusive or falsified rates.

EiQ Data – May 2020

EiQ Data – May 2020

Key takeaways for brands during the post COVID-19 recovery:

- Build solid and trustworthy relationships with your supplier base by keeping business commitments and investing in long term relationships.

- Assess the impact of COVID-19 on specific indicators such as overtime, wages, workers documentation.

- Deploy worker engagement tools – including anonymous surveys to solicit insights from vulnerable workers such as foreign migrant and temporary workers.

- Promote dialogue and open communication regarding social compliance and operations to understand the likely hood of subcontracting.

- Utilize data and analytics tools to assess current and emerging risks.

19 May 2020

Assessor insights from Southeast Asia dated 19 May 2020

This week we spoke with ELEVATE’s Southeast Asia Regional (SEA) team. Our Regional Director, based in ELEVATE’s Viet Nam office, provided us with insights on life under easing restrictions and information on how local assessors are keeping themselves and workers safe during on-site assessments.

Photo credit: REUTERS/Kham/File Photo

Governments in Southeast Asian countries are easing COVID-19 restrictions.

Viet Nam

- The economy has begun to re-open with business resuming for non-essential businesses, with the exception of karaoke bars and discos.

- Daily activities are resuming, facemasks are required.

- Domestic flights are almost back to normal, with hopes of being at 100% capacity by June.

- Viet Nam continues to keep its boarders closed to Cambodia.

- April saw 30% of textile and apparel workers were underemployed, increasing to 50% in May (source).

- Vietnam’s textile and garment export turnover was down 2.02% compared to the same period of 2019 (source).

Cambodia

- All travelers must commit to a 14 day quarantine upon entering Cambodia.

- COVID-19 cases remain low, strict sanitary measures are in place such as washing hands and wearing face masks.

- Transport restrictions have led to reductions in manufacturing and decrease in worker overtime hours.

- Garment unions are leaning on brands to contribute 40% of minimum wages for factory workers.

Photo creidt: Romeo GACAD / AFP

Thailand

- As of May 15th, domestic flights in Thailand are widely available, however boarders remain closed with the exception of mainly migrant workers and visitors who hold a temporary boarder pass.

- Hundreds of thousands of migrants who traveled to Thailand for work have lost their jobs. They are particularly vulnerable to the economic impact of the pandemic and when they return to work, find themselves at risk for cluster outbreaks in dormitory accommodations.

- International Office of Migration (IOM) is producing videos specifically for migrant workers on reducing risk and infection of COVID-19 during travel (source).

- Foreign migrants workers are being urged to remain in Thailand and not travel to their home country, but loss of jobs is compelling them to leave as many are undocumented and or are ineligible for government assistance (source).

- Factories that are still producing in this region are open with 70-80% capacity, 20% factories pre-COVID-19 are no longer in business due to the pandemic.

- For some brands and factories desktop and virtual assessments have been developed and are in pilot in lieu of onsite assessments.

Any assessor displaying symptoms of cough, sneeze or temperatures over 100° F (38°C) needs to notify managers and is advised to see a doctor. At all times assessors follow legal and factory guidance. Each assessor wears face masks and enforces a 6 ft. (1.5m) distance between factory workers and managers while continuing to practice personal hygiene and hand washing. If any risk is found at a site this is directly reported to coordinators and managers.

ELEVATE has observed factories in the SEA region following recommendations for best health and safety practices:

- Temperature tests upon entry to the facility

- Hand washing sanitation at main entrances

- Visual signs outlining personal protective equipment (PPE) guidelines

- Procedures for emergency reporting hotline

Worker interviews continue to take place. The interviewer and workers keep a safe distance and no more than four workers are part of the group interview. Factory employees that are working report they are happy to have jobs and are proud to be a part of businesses that continue to weather the storm.

12 May 2020

Auditing practice updated: ELEVATE COVID-19 preparedness observations dated 12 May 2020

ELEVATE has taken into consideration the many ways that COVID-19 has impacted business operations and risk management. As a trusted service provider and reliable advisor to our clients ELEVATE has created new tools to monitor supply chains in the pandemic era. These tools include ELEVATE’s COVID-19 remote worker wellness training, remote readiness questionnaires, desktop verification, worker engagement surveys, as well as an on-site COVID-19 checklist.

ELEVATE is beginning to perform assessments in various regions (e.g. China, Vietnam, Italy, Bangladesh, etc.) as restrictions are being lifted. Effective as of May 11, 2020 all ELEVATE on-site assessments are required to complete the COVID-19 preparedness observation form. This additional form focuses on the collection of observations made by the auditor about the health and safety of workers in light of COVID-19, to ensure factories and factory management are providing information on COVID-19 and direction on what to do if someone exhibits symptoms, as well as observing factory cleanliness and availability of personal protective equipment (PPE).

Additionally, ELEVATE has created internal guidance per country to support ELEVATE assessors in checking against local COVID-19 legislation including health & safety, wages, and time off. ELEVATE will continue to create internal guidance as countries ease COVID-19 restrictions and manufacturing resumes.

Country regional updates: Insights into life in Italy dated 12 May 2020

As part of ELEVATE’s weekly COVID-19 blog, we spoke to Daniele Giomi, ELEVATE’s European Regional Manager located in Florence, for his insights on Italy emerging out of the Coronavirus epidemic:

On May 4 the government softened restrictions and. 4.5 million people returned to work. Working life is totally different than before the outbreak. Workers are now required to follow these precautions:

- Body temperatures are checked at the entrance of buildings and factories

- Masks and gloves are required

- Workers must continuously sanitize and their wash hands

- Shifts have been altered to avoid a high presence of workers at the same time

- Social distancing is enforced at all times

- The work environment and machines are sanitized

The food and agricultural sectors, considered essential industries, never stopped working. Their approach is looked at as an example of best practices for all other industry sectors to reopen. Citizens and workers are taking these precautions seriously and have applied them consistently during normal day-to-day life.

If the trend of COVID-19 infections continues declining or at least remains stable, there is expected to be further reduction of restrictions. There is a possibility that shops, bars and restaurants will reopen on May 18

A cyclist passes the Trevi Fountain, as Italy begins to ease some of the restrictions of the coronavirus disease (COVID-19) lockdown, in Rome, Italy May 7, 2020.

A cyclist passes the Trevi Fountain, as Italy begins to ease some of the restrictions of the coronavirus disease (COVID-19) lockdown, in Rome, Italy May 7, 2020.

REUTERS/Guglielmo Mangiapane

In Italy we are now allowed to move from one region to another for work. As such ELEVATE auditors have resumed activities and are carrying out audits, while respecting safety rules and in compliance with local recommendations and guidance.Our work in social compliance will be even more important. While onsite, ELEVATE auditors will observe if any rules are not respected and identify potential issues for worker health and safety. This is accordance with ELEVATE’s updated global audit policy.

We are in the middle of a difficult time, but I have never before seen Italian people so united, collaborative and helping each other with the awareness that our future is based on a more sustainable world.

5 May 2020

ELEVATE statement on staff and customer safety dated 5 May 2020

Since the outbreak of the Coronavirus in December 2019 and in its rapid global spread ELEVATE has worked around the clock to ensure the safety and well-being of our employees and to respect the safety of our customers. ELEVATE follows the guideline as set forth by the World Health Organization (WHO). By doing so, ELEVATE has continued our efforts to slow the spread of the virus. The ELEVATE team has taken the following global health precautions and measures:

- Issued a companywide guidance on health advice/preventive measures on COVID-19

- Stationed hand-sanitizer and implemented temperature tests at workplaces

- Administered personal protective equipment and guidance on these materials to employees, at offices, field-based locations and customer locations

- Require employees and visiting guests complete a health and travel status form

- Shared WHO’s how to cope with stress during COVID-19

- Paused all global non-essential travel

While safety remains our priority, ELEVATE is committed to providing exceptional service to our clients and to educating thousands of supply chain managers and workers on essential precaution measures and workplace health and safety recommendations through virtual trainings including webinars and eLearning courses.

27 April 2020

Letter from CEO Ian Spaulding dated 27 April on ELEVATE’s response to the business impact of COVID-19

I first wrote to our customers and partners in late January about the impact of coronavirus on China supply chains and our business. Since this time, we’ve seen the virus become a global pandemic and crisis that has impacted every business and member of society. It’s been hard to witness the scale of disruption and ultimately the closures, suspensions of services, furloughs and retrenchment as we adjust and prepare for an emerging “new normal”.

I first wrote to our customers and partners in late January about the impact of coronavirus on China supply chains and our business. Since this time, we’ve seen the virus become a global pandemic and crisis that has impacted every business and member of society. It’s been hard to witness the scale of disruption and ultimately the closures, suspensions of services, furloughs and retrenchment as we adjust and prepare for an emerging “new normal”.

The unprecedented rise of COVID-19 and rapidly-changing market conditions have forced ELEVATE to re-evaluate our own cost base and organization. It has also empowered us to look for ways to be faster, stronger and better … for our customers, for the industry, for our business and most importantly for our trusted team of over 500 associates globally. Yes, the last few months have been the most difficult our industry has ever faced. But at the same time we have also seen this as an exceptional moment to reflect, plan and innovate a more resilient future.

I am grateful that we are uniquely well placed to respond to the industry’s new and emerging needs. A vital part of this future are data and analytics! We continue to expand our EiQ supply chain intelligence platform in ways that support our customers with more proactive risk management, to predict and handle disruptions, innovate and build resiliency. This tool has proven invaluable as our customers seek to design a more effective and impactful program that mitigates risk and drives greater performance.

We also continue to expand in new and essential markets such as food and agriculture and geographically in South America, Europe and the Middle East. For suppliers and producers, we’re building tools and solutions that improve their competitiveness and ability to continuously improve in highly challenging market conditions. Understanding our customers’ increasing need for remote solutions, we are also innovating with scalable, accessible online eLearning, desktop verifications and virtual assessments. We have been doing some of this for many years; however, the recent crisis has accelerated the timeline for bringing new innovations to market. To learn more about these innovations, please reach out to us via info@staging12.elevatelimited.com.

Finally, our growing COVID-19 Resource Center is designed to equip our customers and the industry with ELEVATE’s guidance and insights to navigate the next stage of the coronavirus in ways that enable us all to build back better. Look out for the recording of our popular webinar with the Equitable Food Initiative (EFI), Sustaining Food Supply While Keeping Workers Safe. You can also register for the much-anticipated English-language version of the Wellness at Work: Supporting Workers During COVID-19 webinar that is going live in late April and early May.

Let me close by acknowledging that none of us has experienced anything quite like COVID-19. It’s painful and sad on so many levels. Nonetheless, I am an eternal optimist. We will all ultimately build back better together. A silver lining in all of this has been the opportunity to reflect and re-engineer the tools, solutions and approaches we use to drive sustainability.

To our customers and partners, I want to thank you for your continued partnership and support. To team ELEVATE, I want to give a special thanks for your hard work, innovation, dedication to ELEVATE and ultimately your trust in me and our management team to lead the company to greater heights in the months and years to come.

Wishing you all great health and resilience during this difficult time.

Very best regards,

Ian Spaulding

CEO, ELEVATE

10 April 2020

ELEVATE update on COVID-19 dated 10 April 2020

China continues to resume operations while practicing preventive measures to avoid a fresh wave of the COVID-19 outbreak. The lockdown in Wuhan has lifted and ELEVATE associates throughout Hubei are now back in their base cities, undergoing additional quarantine as required. In China, ELEVATE continues to carry out scheduled social and environmental compliance audits throughout the country, and receive new requests for audits.

Across geographies where ELEVATE works – South Asia, Southeast Asia, Australia New Zealand, EMEA, North America and South America – lockdowns are in place through mid- to late-April, reflecting the contagion’s spread and peaking in different regions.

ELEVATE teams continue to progress projects and support customers, either by working from home or in our offices, where safe and practicable.

We have consolidated guidance at the ELEVATE COVID-19 Resource Center to help our customers and the industry navigate the next stage of the coronavirus. Note the updated blogs, webinars, and innovative solutions at the resource center, including:

ELEVATE + EFI Webinar: Sustaining food supply continuity while keeping workers safe on 21 April 2020 at 09:00 (PT) and 10:00 (CET).

Save the date: Wellness at Work – Factory worker safety during COVID-19 (English language) – 28 April, 30 April and 5 May.

Insight for brands, retailers and facilities

Many of our customers are working hard to adapt quickly to the new business reality. Essential businesses continue to work with their factories, but are being sensitive to their suppliers’ fragile financial condition. For non-essential businesses, particularly retail and apparel customers, the response has been to quickly reduce and / or cancel orders while furloughing their store employees and many head office staff.

While everyone is still operating in a very un-normal environment, there is early interest in planning for what’s next. ELEVATE is holding conversations with its retail and brand customers on how the social responsibility function and related activities may change in the post-COVID-19 world and the budget and organizational implications. We are hearing a greater openness to prioritizing more rigorous risk monitoring, shifting from auditing to scope to auditing to risk, and the use of a variety of different tools for program effectiveness.

If you would like to learn more or have questions, please contact us.

31 March 2020

ELEVATE update on COVID-19 dated 31 March 2020

While the COVID-19 contagion has peaked in China, the pandemic has spread globally with billions of people in lockdown. In Europe, Italy and Spain have been extremely hard hit. UK and USA are a couple of weeks behind Italy, and the numbers of confirmed cases and deaths are spiking in hot spots, most notably the New York metropolitan area.

In many geographies worldwide, country- or region-wide lockdowns are in effect through mid- to late-April, and possibly beyond. China is largely open, and the quarantine in Wuhan is expected to be fully lifted by 8 April.

Insight for brands, retailers and facilities

Factory production in China is on track to be restored by late April or early May. ELEVATE has a robust schedule of confirmed audits and in-factory consulting assignments in China for April, although some capacity still exists.

The remainder of Q2 and the start of Q3 look more uncertain. The market is reacting to rapidly slowing demand during the deep economic downturn. Many non-essential physical retail stores have closed their doors, furloughed employees, and halted orders.

Most companies are in uncharted waters in terms of navigating through a widespread pandemic and returning to full health. Still, ELEVATE is seeing many companies attempting to find creative ways to support their employees and their suppliers during this time.

To help factories in China return to full health, ELEVATE has sponsored the Wellness at Work webinar series (in Chinese language): Supporting workers during an epidemic 用中文呈现 and Understanding employment regulations in China during COVID-19 用中文呈现.

We will communicate soon about an upcoming English-language Wellness at Work webinar for additional geographies, including a focus on farm workers in essential food supply chains.

ELEVATE employees

ELEVATE staff in Europe and the Americas continue to work mostly from home to prevent the spread of the coronavirus while servicing customers’ requests and progressing consulting assignments. We are observing local shelter-in-place regulations. Frequently-updated guidance on health advice for the prevention of COVID-19 and on business travel has been issued to all staff, in addition to health status checks.

If you would like to learn more or have questions, please contact us.

17 March 2020

ELEVATE update on COVID-19 dated 17 March 2020

ELEVATE employees

The COVID-19 pandemic has intensified and is impacting economies, organizations, communities, and people globally.

ELEVATE staff in Europe and the Americas are largely working from home to prevent the spread of the coronavirus while servicing customers’ requests and progressing consulting assignments. Our teams are observing any local shelter-in-place regulations. Guidance on health advice for the prevention of COVID-19 and on business travel has been issued to all staff, in addition to health status checks.

Staff in Greater China are working normally, and auditors based in Hubei are being allowed to travel outside the province (with the exception of staff in Wuhan). Our Hubei team members will observe a 14-day self-quarantine at their destination in line with government regulations.

The view from China’s factories

Audits and in-factory consulting work are progressing in China. We are able to accept audit requests and schedule facilities audits, with the exception of Hubei Province (where we are delaying due to an abundance of caution). Please contact us with your audit requests and we will work with you to get them scheduled and executed.

ELEVATE continues to support factories in their recovery through the Wellness at Work webinar series (in Chinese language). On 19, 24 and 26 March, ELEVATE will present Wellness at Work – Understanding employment regulations in China during COVID-19 用中文呈现.

This is the last week we will report on China factory survey results since 100% of respondents expect to reopen factories in March. A large majority of factories anticipate being back to full production by the end of April.

Over the past week (10 – 16 March), 45 respondents participated in the ELEVATE factory survey (with 84% of factories in mainland China). Our findings indicate:

- 100% plan to reopen by end-March (unchanged from the previous week)

- 45% expect to be at plan capacity between 80% and 100% when they reopen (vs 42% in the previous week)

- 42% expect to be at plan capacity between 40% and 80% when they reopen (vs 46% in the previous week)

- 13% expect to be at plan capacity under 40% when they reopen (vs 12% in the previous week)

- After facilities reopen, 58% expect 80% to 100% of the workforce to resume (vs 49% the week before); 31% expect 40% to 80% of the workforce to resume (vs 39% the week before); 13% expect less than 40% of the workforce to resume (vs 12% the week before).

- 47% of respondents expect to be back to full production by the end of March (vs 56% in the previous week); 82% expect to be back to full production by the end of April (vs 97% the week before).

Additional insight for brand, retailer and vendor customers

- Our customers continue to be concerned about delayed shipments and impacts on sourcing but are supporting factories and suppliers with flexible due dates and audit schedules until the environment is safe again.

- We are seeing some detrimental impacts on factories outside China, with some factories forced to close in Vietnam and Cambodia due to governmental regulations and a lack of raw materials.

If you would like to learn more or have questions, please contact us.

11 March 2020

ELEVATE update on COVID-19 dated 11 March 2020

Impact on Europe / Italy

COVID-19 cases have been diagnosed in all European countries. The Italian government has extended the lockdown across the entire nation, with effect currently from 10 March to 3 April.

While the instruction in Italy allows people to travel to work for valid reasons, we expect many factories to close or not permit visitors on the premises.

All of our associates in Italy are well and taking the standard precautions as described in our 6 March update, below. Our staff are working remotely while they verify the status of factories and determine if confirmed audits remain confirmed or need to be postponed.

The view from China’s factories

Travel restrictions in China continue to lift. Factories are opening and capacity is increasing. However, shortages of raw materials and workers and logistics continue to impact the return to full production.

Over the past week (3 – 9 March), 71 respondents participated in the ELEVATE factory survey (with 92% of factories in mainland China). Our findings indicate:

- 96% plan to reopen by 10 March (vs 100% reporting in the previous week they would open by 10 March)

- 42% expect to be at plan capacity between 80% and 100% when they reopen (vs 23% in the previous week)

- 46% expect to be at plan capacity between 40% and 80% when they reopen (vs 49% in the previous week)

- 12% expect to be at plan capacity under 40% when they reopen (vs 28% in the previous week)

- After facilities reopen, 49% expect 80% to 100% of the workforce to resume; 39% expect 40% to 80% of the workforce to resume; 12% expect less than 40% of the workforce to resume.

- 56% of respondents expect to be back to full production by the end of March (vs 77% in the previous week); 97% expect to be back to full production by the end of April.

Additional insight for brand, retailer and vendor customers

- ELEVATE continues to schedule more social compliance audits and assessments in China. Similarly, ELEVATE is seeing China-based in-factory consulting engagements increase in March.

- Some customers are continuing to place holds on audits until the end of March. We are observing some audit cancellations in countries that have are not categorized by the U.S. CDC as level 2 or 3 risk countries.

- Overall, factory capacity in China is on the rise and customers generally expect capacity to be at 100% by end-April, in line with factory projections.

If you would like to learn more or have questions, please contact us.

6 March 2020

ELEVATE update on COVID-19 dated 6 March 2020

Impacts from COVID-19 in Europe

The coronavirus has most heavily impacted the Italian regions of Lombardy in the northwest and Veneto in the northeast. Small areas within these two regions are under quarantine, and ELEVATE auditors are not visiting factories in those segregated areas. Social compliance audits and assessments are still being carried out at factories and facilities in Lombardy and Veneto outside the quarantine areas. As of 6 March, only one audit has been postponed and our schedule is not impacted. We are working closely with all factories to understand their concerns and logistics.

Considering that most European countries are now being impacted by COVID-19, factories across Europe are making enquiries as to our auditors’ travel history and health status. We are communicating frequently to inform them of the health of our field auditors and where they have travelled during the 14-day period prior to factory visits. Currently none of our ELEVATE associates has been diagnosed with the COVID-19 virus.

All the normal precautions are in place including frequent and thorough hand washing, not touching your face, staying home if ill and consulting a doctor promptly, not shaking hands, maintaining a minimum distance of 1+ meter from other people, avoiding crowds, and so on. Our staff are following local official and health advisories and guidelines during site visits.

We are also following WHO’s workplace guidance and adopting lessons learned in China including Hong Kong.

If you would like to learn more or have questions, please contact us.

4 March 2020

ELEVATE update on COVID-19 dated 4 March 2020

The view from China’s factories

Travel restrictions in China have begun to lift and the government has eased the approval process for factories to reopen. While some progress is being made, the remaining travel restrictions, quarantines and shortage of workers and raw materials continue to hamper the return to full production in China.

ELEVATE has surveyed factories in China since the week of 3 February. Over the past week (25 February – 2 March), 57 respondents of the ELEVATE factory survey indicated:

- 95% plan to reopen by 2 March (vs 84% reporting in the previous week they will open by 1 March)

- 23% expect to be at plan capacity between 80% and 100% when they reopen (vs 32% in the previous week)

- 49% expect to be at plan capacity between 40% and 80% when they reopen (vs 32% in the previous week)

- 28% expect to be at plan capacity under 40% when they reopen (vs 36% in the previous week)

- 77% of respondents expect to be back to full production by the end of March (vs 80% in the previous week)

Additional insight for brand, retailer and vendor customers

- ELEVATE has scheduled social compliance audits and assessments in China for the week of 9 March 2020 and beyond. The numbers are increasing.

- Our outreach to ELEVATE customers who are brands, retailers and vendors shows they are increasingly being impacted by raw material shortages and difficulties shipping raw materials to other producing countries (notably India and Vietnam). However, many customers have reported they are optimistic that factory capacity will be at 70% – 80% by the April / May time frame and are hopeful that production will be back to normal in May.

- Some customers have mentioned that the government has begun encouraging workers in China to resume work, but factories in some regions still require a 2-week quarantine period before workers are allowed back in facilities.

- In Italy, ELEVATE team members are not in factories in the 2 quarantine areas (1 in Lombardy and 1 in Veneto). We are working closely with all factories to understand any issues and concerns. We are not expecting a reduction in social audits and assessments during March, and only 1 audit has been postponed to date.

- ELEVATE is working with customers to mitigate the disruption in China and other markets dependent on raw materials from China. Where possible, customers are advancing audit programs in Latin America, South Asia, and Southeast Asia. If you would like to learn more or have questions, please contact us.

Helping factories through the transition

To help factory owners, managers and supervisors prepare for the ramp up in production, ELEVATE has hosted complimentary Chinese-language webinars on Wellness at Work – Supporting Workers During an Epidemic. The last webinar concludes on 5 March, and the recording will be available on the ELEVATE website.

ELEVATE has also created a Wellness at Work eLearning curriculum to help workers return to work safely and productively. It provides almost 3 hours of best-practice information related to managing health and safety and providing workers with adequate channels for communication. It is now available on the ELEVATE eLearning Store at a 40% discount to help factory owners, managers and supervisors as they move towards full production.

If you would like to learn more or have questions, please contact us.

25 February 2020

ELEVATE update on COVID-19 dated 25 February 2020

What’s new for our customers: operational implications

While a decline in coronavirus infections in China may be underway, manufacturing productivity remains hampered in part by travel restrictions. Some of these are beginning to lift.

The Chinese government is easing the approval process for factories to reopen. Rather than seeking approval in advance, some factories need to be ready for an inspection after opening.

ELEVATE has surveyed factories in China since the week of 3 February. Over the past week, confidence in the ability to reopen and achieve plan capacity quickly has eroded somewhat. For the week 18 – 24 February, 44 new respondents of the ELEVATE factory survey indicated:

- 84% plan to reopen by 1 March (vs 91% reported in the previous period)

- 32% expect to be at plan capacity between 80% and 100% when they reopen (vs 25% in the previous period)

- 32% expect to be at plan capacity between 40% and 80% when they reopen (vs 42% in the previous period)

- 36% expect to be at plan capacity under 40% when they reopen (unchanged from the previous period)

- 80% of respondents expect to be back to full production between the end of February and the end of March (vs 85% in the previous period)

To help factory owners, managers and supervisors prepare for the ramp up in production, ELEVATE is hosting complimentary Chinese-language webinars on 27 Feb, 3 March and 5 March: Wellness at Work – Supporting workers during an epidemic. We invite factories to register here or visit the ELEVATE website.

ELEVATE was approved to reopen its offices in mainland China. With effect from 24 February, office-based teams have resumed work in our Shenzhen, Hangzhou and Shanghai offices with full sanitary precautions in place to keep our people healthy.

Additional insight for brand, retailer and vendor customers

- Our customers’ concerns have shifted from a week ago. While factories are still closed or running at low capacity, the trend now looks to be a lack or delay in raw materials, including fabric and packaging materials.

- Similarly, the transfer of goods out of China has slowed as container ships are by-passing China ports.

- Our customers have also pointed out that factories outside China may face worker strikes as workers are concerned about the virus and return of Chinese managers back at work.

- ELEVATE is working with customers to mitigate the disruption in China and other markets dependent on raw materials and textiles from China. Where possible, customers are advancing audit programs in Latin America, South Asia, and Southeast Asia. If you would like to learn more or have questions, please contact us.

18 February 2020

ELEVATE update on COVID-19 dated 18 February 2020

Highlights

- A survey of factories indicates that facilities are reopening starting from 10 February to 28 February; 95% of respondents have indicated they will reopen on 10 February or 17 February.

- Travel restrictions in mainland China are hampering workers’ ability to resume work. Factories estimate the percentage of workforce resuming after facilities open as follows: Between 80% and 100% (29%), Between 40% and 80% (41%), Under 40% (30%).